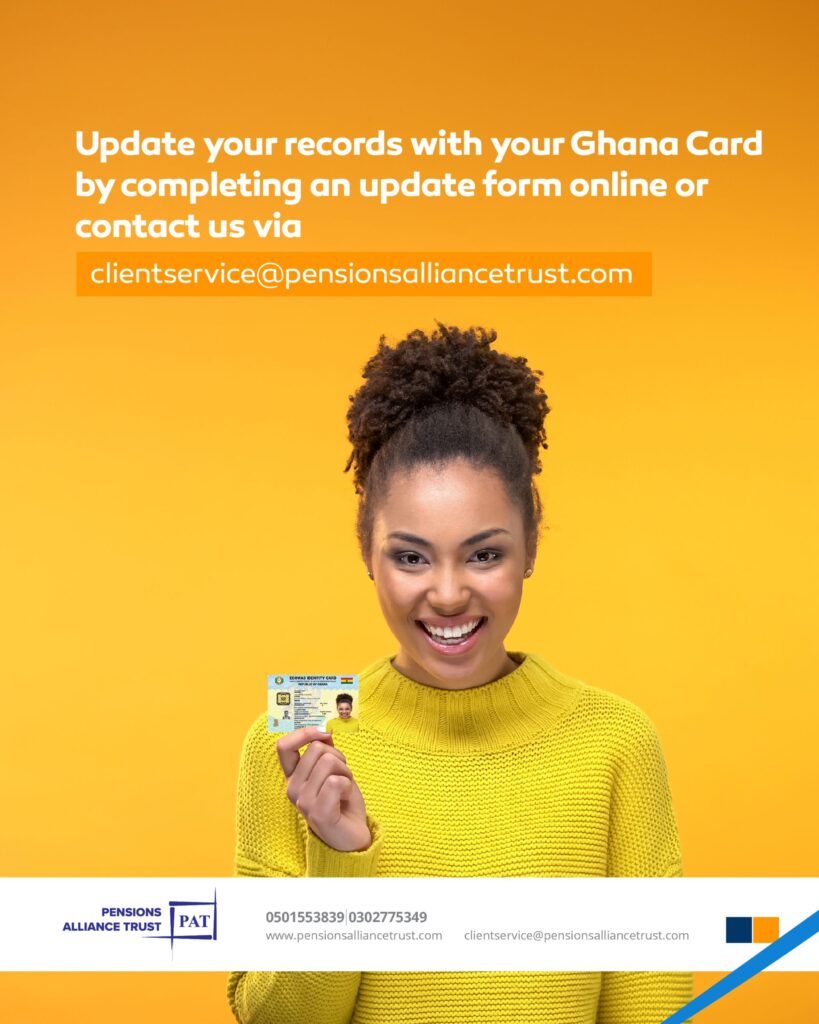

Welcome To Pensions Alliance Trust:

A Trustee you can depend on

CORE VALUES

Teamwork

We involve our clients in decision making.

Accountability

We report regularly to our clients.

Honesty

We ensure our clients have full knowledge of their funds.

CEO's Message

Dearly Cherished Partners and Prospective Members,

Greetings and welcome to Pensions Alliance Trust.

We are delighted to have you as a member of our community. Please feel free to explore, discover and interact with us as we work jointly to ensure the attainment of your long-term savings and retirement goals.

At Pensions Alliance Trust, we take great pride in the quality of our work and the ultimate satisfaction of our highly esteemed community members. Our consummate professionals are Committed to Excellence, are Powered by Learning and are Proud to Serve. So, whether you are an existing member; or a prospective member; and whether your needs relate to Staff Occupational Tier 2 Pension Scheme or the Voluntary

Tier 3 Pension Scheme; or to our Personal Pension Scheme (Wealth Builder Scheme); whatever your needs are, Pensions Alliance Trust has a uniquely tailored solution for you.

Undoubted technical competence, Industry know-how, a “can do” attitude, absolute transparency and adherence to rules and regulations inform Pensions Alliance Trust’s unique corporate spirit.

We shall always stand with and by you. Trust us!

Ing. Ras A. Boateng, CFA

Chief Executive Officer,

Pensions Alliance Trust

Ing. Ras A. Boateng, CFA

Chief Executive Officer, Pensions Alliance Trust

Dearly Cherished Partners and Prospective Members,

Greetings and welcome to Pensions Alliance Trust.

We are delighted to have you as a member of our community. Please feel free to explore, discover and interact with us as we work jointly to ensure the attainment of your long-term savings and retirement goals.

At Pensions Alliance Trust, we take great pride in the quality of our work and the ultimate satisfaction of our highly esteemed community members. Our consummate professionals are Committed to Excellence, are Powered by Learning and are Proud to Serve. So, whether you are an existing member; or a prospective member; and whether your needs relate to Staff Occupational Tier 2 Pension Scheme or the Voluntary Tier 3 Pension Scheme; or to our Personal Pension Scheme (Wealth Builder Scheme); whatever your needs are, Pensions Alliance Trust has a uniquely tailored solution for you.

Undoubted technical competence, Industry know-how, a “can do” attitude, absolute transparency and adherence to rules and regulations inform Pensions Alliance Trust’s unique corporate spirit.

We shall always stand with and by you. Trust us!

Our Featured Services

Why choose Pensions Alliance?

Safety

The safety of your investment is the primary objective of the scheme. Investments are undertaken to ensure that we preserve the capital and generate returns comparable in the industry.

Data Security

We have a robust IT Infrastructure that ensures adequate protection of our clients information.

Liquidity

We maintain an investment portfolio with sufficient liquidity to enable us to meet all pension commitments. Additionally, there is a mix of long and short-term investments which optimize the return on the portfolio.

Call Us

0302 798 652

Trusted by